Verity • n

Our comprehensive suite of services is designed to identify, evaluate, and capitalize on groundbreaking opportunities across various sectors.

By leveraging our expertise and extensive network, we provide access to under-the-radar future leaders and innovative startups, as well as proactively reaching out to mid-stage growth ventures. This ensures your investments are strategically positioned for rapid growth in truly valuable ventures.

Visionary Foresight

Comprehensive Planning Solutions for Strategic Growth

- Curated insights into disruptive technology trends and applications

- Briefings to inspire vision around transformational opportunities

- Evaluating disruptive innovation impacts across industries

- Developing a future-focused vision and investment roadmap

- Foresight on market trajectories, paradigm shifts, and megatrends

- Scenario planning for potential technology disruption opportunities

- Forums with thought leaders, technical experts, and entrepreneurs

- Conducting in-depth research on technology sector trends

- Analyzing market sizing, competitive landscapes, and future growth potential

- Identifying emerging opportunities across verticals

- Crafting an investment thesis and strategy for direct private investments

- Defining target sectors, stages, investment structures, and return profiles

- Establishing investment criteria, policies, and governance

- Developing a long-term asset allocation strategy aligned with investment objectives

- Optimizing portfolio construction across asset classes, sectors, and geographies

- Modeling expected returns, risk profiles, and efficient frontiers

Deal Sourcing

Exclusive Deal Sourcing to Identify Prime Opportunities

- Leveraging proprietary networks to source direct investment opportunities

- Proactively identifying non-marketed private investment opportunities

- Curating opportunities aligned with your sector focus and return objectives

- Managing inbound deal inquiries and triage

- Identifying co-investment opportunities to increase investment scale

- Building relationships with complementary investment partners

- Structuring and negotiating co-investment terms

- Streamlining the deal sourcing process

- Prioritizing opportunities based on strategic fit

- Regularly updating the deal pipeline with new opportunities

- Continuous monitoring of market trends and opportunities

- Staying ahead of emerging trends and investment opportunities

- Providing actionable intelligence to inform sourcing strategies

Due Diligence

Rigorous Due Diligence for Informed Investment

- Comprehensive reviews of existing investment portfolios

- Evaluating performance, exposures, and future capital needs

- Recommending rebalancing, exits, and follow-on investments

- In-depth assessment of companies’ business models

- Evaluation of management teams and their track records

- Analysis of company culture and operational strategies

.

- Financial modeling and valuation analysis

- Market sizing and competitive landscape evaluation

- Growth potential and scalability assessment

- Leveraging our operating experience for detailed evaluations

- Assessing technology stacks and intellectual property

- Identifying technical risks and mitigation strategies

Deal Execution

Seamless Deal Execution for Optimal Outcomes

- Negotiating deal terms to protect your interests

- Structuring and financing investments

- Managing the closing process

- Serving as the direct point of contact for your private investments

- Actively monitoring and managing your portfolio companies

- Providing ongoing reporting and performance analysis

- Assessing investment risk factors and developing mitigation plans

- Ongoing portfolio monitoring and risk management

- Implementing governance and compliance best practices

- Supporting portfolio companies post-investment

- Providing strategic guidance and operational support

- Facilitating value creation initiatives

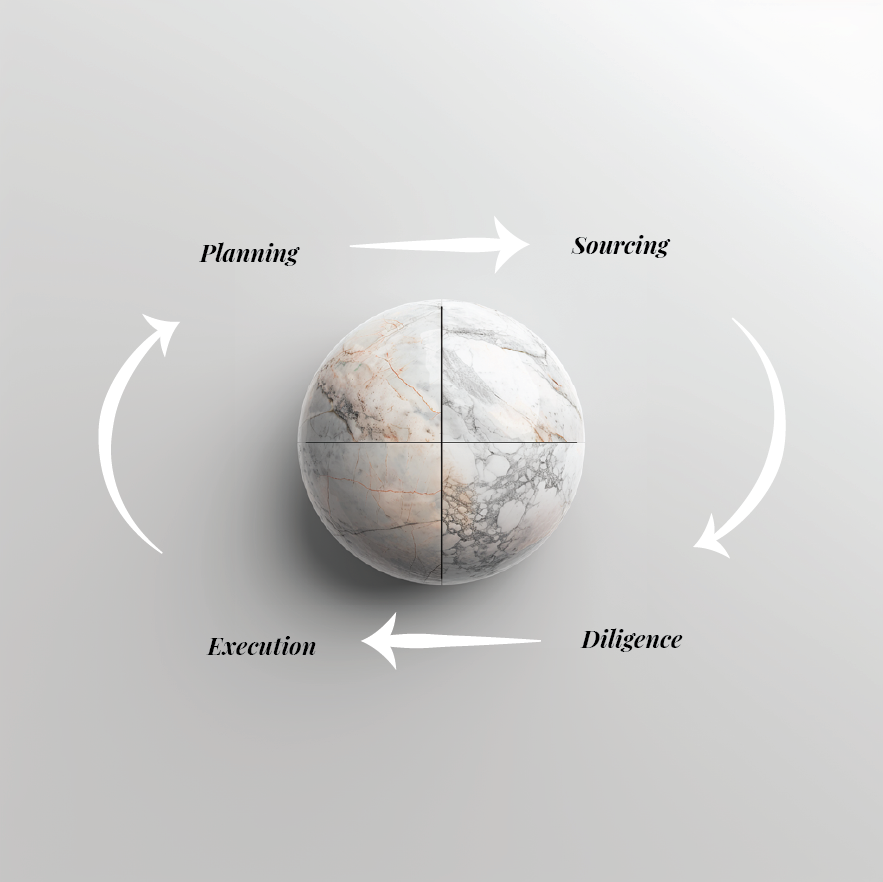

Cyclical Value Framework

Set and forget simply does not apply to opportunities with exponential and disruptive potential. Our ongoing cyclical approach requires revisiting assumptions, narratives, and networks to ensure continuous alignment with evolving market dynamics and potential.

5 Truths of Value

At Verityn, we uncover authentic opportunities through a meticulous process: aligning your Thesis with market trends, evaluating the Tech’s uniqueness, vetting the Team’s vision and capabilities, predicting the Trajectory of growth, and maintaining Transparency to build trust and credibility.

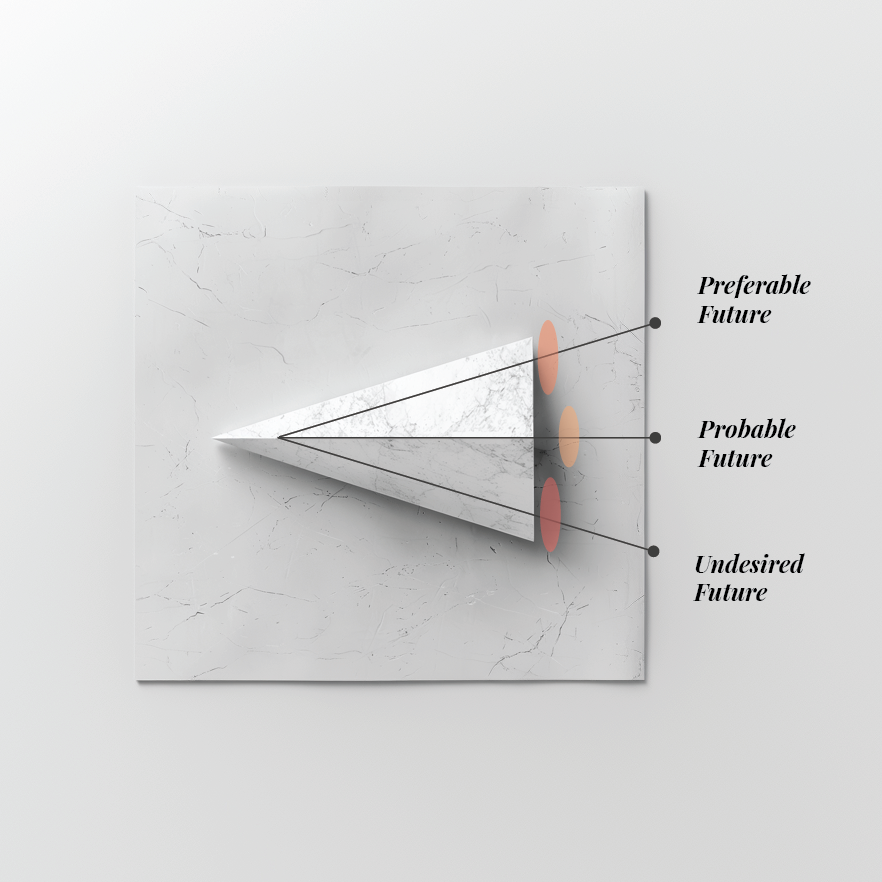

The Futures Cone

Failing to plan is planning to fail. Hope is not a strategy. We balance what could happen, what is likely to happen, and what we want to happen to surface the best opportunities, ensuring our strategies are resilient, adaptable, and poised for success.

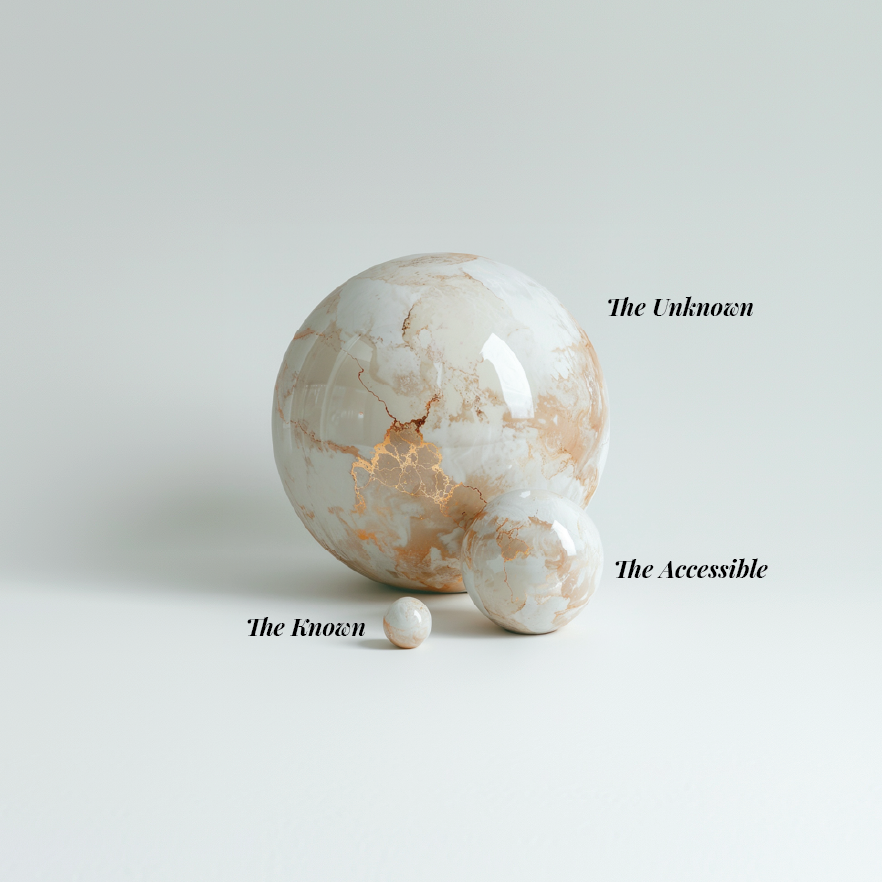

The Uncharted Framework

What we don’t know is exponentially greater than what we do. Navigating with fear or hubris can lead to unfortunate outcomes. At Verityn, we turn uncertainty into opportunity by embracing rigorous verification, expansive research, and strategic focus, transforming unknowns into calculated investments.